Events

GroupPOLYMARKET

Event GroupPOLYMARKETClimate

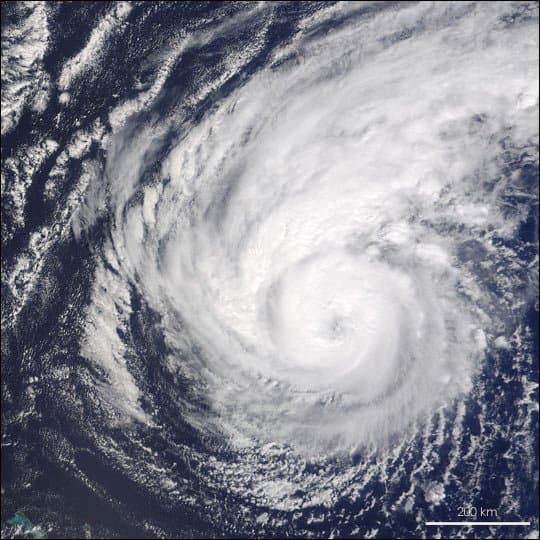

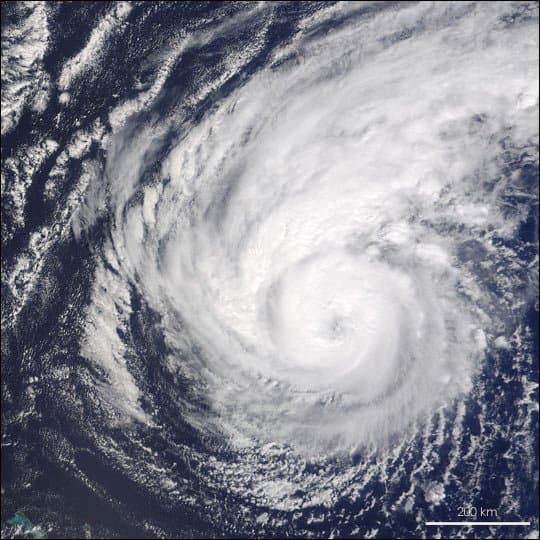

Will a hurricane make landfall in the US by May 31?

Total Volume

$4.41K

Events

1

Markets

1

Will a hurricane make landfall in the US by May 31?

Platform StatsQuick Platform Comparison

Polymarket

1

markets · $4.41K

Kalshi

0

markets · $0.00

Price Spread

0.0%avg

max 0.0%

Arbitrage

0

of 0 cross-platform

Volume DistributionTotal: $4.41K

100%

Polymarket leads

Price ChartMatched Markets Price Graph

1 market tracked

Will a hurricane make landfall in the US by May 31?

No data available

Single-Platform Markets(1)

| Market | Platform | Price |

|---|---|---|

| Poly | 6% |

AI Analysis

Trader mode: Actionable analysis for identifying opportunities and edge

6%

Top Probability

$4.41K

Volume

1

Markets

1

Platforms

About This Event

This market will resolve to "Yes" if a hurricane makes landfall in the conterminous United States within this market's timeframe, between December 4, 2025, and May 31, 2026, 11:59 PM ET as described in official National Hurricane Center advisories (https://www.nhc.noaa.gov/archive/2025/). If no tropical systems make landfall in the conterminous United States at hurricane status within this market's timeframe, this market will resolve to "No". This market may only resolve to "No" after May 31, 2

What Prediction Markets Are Forecasting

Prediction markets currently give about a 6% chance that a hurricane will hit the continental United States before June 1. In simpler terms, traders see this as very unlikely, with roughly a 1 in 16 chance. This low probability reflects the strong seasonal pattern of hurricane activity, which typically ramps up in the summer and fall.

Why the Market Sees It This Way

The forecast is based on two main factors. First, the official Atlantic hurricane season runs from June 1 to November 30. The period covered by this market, December through May, is climatologically quiet. Historically, fewer than 2% of all U.S. hurricane landfalls have occurred in these months.

Second, while rare off-season storms can form, they usually require very specific and unstable conditions, like unusually warm ocean water or lingering weather patterns from the active season. The market's low odds suggest traders do not see current long-range forecasts pointing to those abnormal conditions developing in the next few months.

Key Dates and Events to Watch

The primary date is the market's resolution deadline of May 31. Before then, watch for official outlooks from forecasting agencies. The National Oceanic and Atmospheric Administration (NOAA) typically releases its initial seasonal hurricane outlook in late May. An early and unusually active forecast could shift probabilities slightly. More immediately, any named storm formation in the Atlantic or Gulf of Mexico before June would be a significant signal, as it could indicate an early start to the season.

How Reliable Are These Predictions?

Markets are generally reliable for forecasts tied to clear seasonal and historical patterns, like this one. The historical record for pre-June hurricane landfalls is very small, making the "No" outcome a strong baseline prediction. The main limitation is the inherent unpredictability of weather. A single unexpected storm could defy the odds, but the market is pricing that as a low-probability outlier. For context, the last hurricane to make U.S. landfall in May was Alma in 1970.

Current Market Outlook

The prediction market assigns a 6% probability that a hurricane will make landfall in the conterminous United States by May 31, 2026. This price, equivalent to 6¢ on a yes/no contract, indicates traders view an early-season hurricane strike as a remote possibility. With only $4,000 in total trading volume, liquidity is thin and the consensus is not strongly tested by large capital. A 6% chance suggests the market sees this event as unlikely but not impossible, a typical stance for off-season meteorological risks.

Key Factors Driving the Odds

Two primary factors explain the low probability. First, the historical record shows hurricane landfalls before June 1 are exceedingly rare. According to NOAA data, only about 2% of all U.S. hurricane landfalls have occurred in May. The official Atlantic hurricane season runs from June 1 to November 30. Second, current seasonal forecasts from Colorado State University and other leading institutions do not anticipate pre-season tropical development significant enough to reach hurricane strength and hit the U.S. coastline. Oceanic and atmospheric conditions in the winter and spring, such as stronger wind shear, typically suppress major storm formation in the Atlantic basin.

What Could Change These Odds

The odds could increase with an unusual meteorological event. An early start to the season, while rare, is possible. The National Hurricane Center monitors areas like the Gulf of Mexico or the western Atlantic for off-season development, often driven by non-tropical systems transitioning into subtropical or tropical cyclones. A confirmed tropical depression forming in late May that is forecast to strengthen and approach the coast would cause the market price to spike rapidly. Traders will watch for any special tropical weather outlooks issued by the NHC before June 1, which would be the key catalyst for volatility. The market will remain quiet unless forecast models show a credible threat.

AI-generated analysis based on market data. Not financial advice.