Events

GroupPOLYMARKET

Event GroupPOLYMARKETCrypto

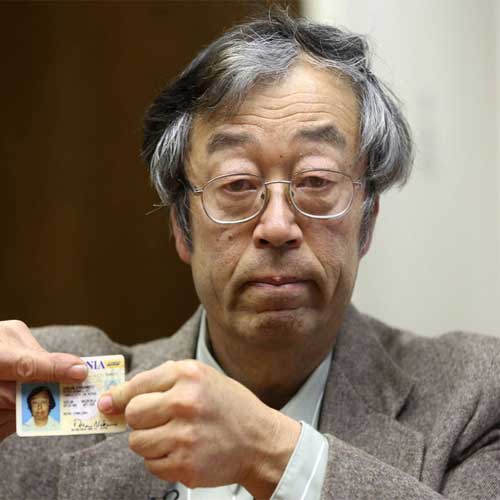

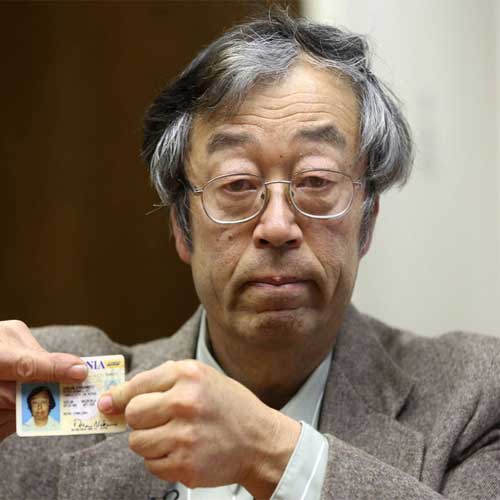

Will Satoshi move any Bitcoin in 2026?

Total Volume

$1.45M

Events

1

Markets

1

Will Satoshi move any Bitcoin in 2026?

Platform StatsQuick Platform Comparison

Polymarket

1

markets · $1.45M

Kalshi

0

markets · $0.00

Price Spread

0.0%avg

max 0.0%

Arbitrage

0

of 0 cross-platform

Volume DistributionTotal: $1.45M

100%

Polymarket leads

Price ChartMatched Markets Price Graph

1 market tracked

Will Satoshi move any Bitcoin in 2026?

No data available

Single-Platform Markets(1)

| Market | Platform | Price |

|---|---|---|

| Poly | 8% |

AI Analysis

Trader mode: Actionable analysis for identifying opportunities and edge

8%

Top Probability

$1.45M

Volume

1

Markets

1

Platforms

About This Event

This market will resolve to “Yes” if any wallet labeled as belonging to Satoshi Nakamoto on Arkham’s Intel Explorer shows an “Outflow” or “Swaps” transaction at any time between January 9, 2026, 1:00 PM ET and December 31, 2026, 11:59 PM ET. Otherwise, this market will resolve to “No.” The resolution source for this market is Arkham’s Intel Explorer, specifically the entity page for Satoshi Nakamoto available at https://intel.arkm.com/explorer/entity/satoshi-nakamoto If Arkham becomes permanen

AI-generated analysis based on market data. Not financial advice.